Title: Exploring the Advantages and Disadvantages of Digital

In recent years, digital currencies have gained significant traction both in the financial sector and among the general public. These currencies, which are entirely electronic and utilize cryptography for security, have reframed how we think about money. With the rise of cryptocurrencies like Bitcoin and Ethereum, discussions surrounding the benefits and drawbacks of digital currencies have become increasingly pertinent. Understanding these factors not only helps potential investors but also aids governments, businesses, and consumers in navigating this evolving landscape.

### The Advantages of Digital Currencies #### 1. Financial InclusionOne of the most significant advantages of digital currencies is their potential to enhance financial inclusion. Traditional banking systems often exclude individuals in developing countries who lack access to banking infrastructure. Digital currencies can be accessed using a simple smartphone, providing people with an opportunity to participate in the global economy without needing a bank account.

With over 1.7 billion adults worldwide unbanked, the ability to transact digitally can help bridge this gap. Peer-to-peer transactions enable individuals from rural areas to transfer money easily, facilitating business and trade. Initiatives in places like Africa exemplify how digital currencies can fill the economic void left by traditional banking systems.

#### 2. Lower Transaction FeesTransaction fees can be a significant burden when transferring funds, particularly across borders. Traditional banking institutions and remittance services often charge high fees, which can deter users, especially in regions where every penny counts. Digital currencies, on the other hand, can minimize transaction costs significantly. Most cryptocurrencies offer lower fees for transfers, especially when moving funds internationally.

For example, using Bitcoin may incur transaction fees that are a fraction of what a bank would charge for processing a wire transfer. This lower cost structure is appealing to consumers and businesses alike, resulting in increased adoption and usage of digital currencies.

#### 3. Security and PrivacyDigital currencies utilize advanced cryptography and blockchain technology to secure transactions and control the creation of new units. This technology not only makes transactions secure but also minimizes the risk of fraud. Unlike traditional banking systems, where fraudulent activities can lead to identity theft or unauthorized transactions, digital currencies often offer greater protection against such risks.

Moreover, the option for privacy in transactions can be a double-edged sword, but for many users, it remains a significant advantage. The ability to conduct transactions without revealing personal information can protect users from data breaches and exploitation. For those concerned about surveillance or privacy in their financial dealings, digital currencies provide an alternative.

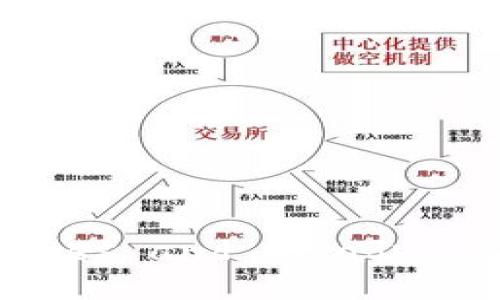

#### 4. DecentralizationAnother appealing characteristic of digital currencies is their decentralization. Traditional currencies are regulated by central banks, which can manipulate the money supply or undergo changes that impact the economy. In contrast, most cryptocurrencies operate on a decentralized network, which means no single entity has control over the currency.

This decentralized nature can make digital currencies more resilient to economic fluctuations and government policies, providing a level of stability against the volatility of fiat currencies. For proponents of free-market principles, this aspect of digital currencies is crucial as it promotes economic freedom and autonomy.

### The Disadvantages of Digital Currencies #### 1. VolatilityOne of the primary disadvantages of digital currencies, particularly cryptocurrencies, is their volatility. Prices can fluctuate dramatically in very short periods, which poses risks for investors and users. A currency that can lose significant value overnight cannot be fully relied upon as a stable store of value.

This volatility can deter businesses from accepting digital currencies as a legitimate form of payment. A company may not want to accept a payment today only to find its value halved the next day. For everyday users, this unpredictability makes it difficult to use digital currencies for standard transactions or savings.

#### 2. Regulatory UncertaintyDigital currencies operate in a grey area regarding regulation. Many governments are still figuring out how to classify and regulate digital currencies, leading to uncertainty for users and businesses. This lack of clear regulation can hinder adoption as businesses may fear the risk of future legal repercussions.

For example, if a government suddenly decides to ban the use of cryptocurrencies, individuals and companies could face sudden and significant losses. Organizations operating in the digital currency space—exchanges, payment processors, or developers—might not know the rules of engagement, causing them to tread cautiously.

#### 3. Technological BarriersWhile digital currencies promise ease of access, they also require users to have a certain level of technical knowledge. Understanding how to securely store, transfer, and use digital currencies can be daunting for individuals without a technical background. Many potential users could be deterred from participating due to these barriers.

Additionally, the risk of losing access to digital funds due to technical errors (for instance, mishandling private keys or falling victim to phishing scams) is a real concern. Educating potential users and providing simple, user-friendly platforms are essential steps to mitigate these risks, but they require resources that may not be fully available.

#### 4. Environmental ConcernsAnother growing concern with digital currencies, particularly those utilizing proof-of-work mechanisms like Bitcoin, is their environmental impact. The process of mining cryptocurrencies requires substantial computing power and electricity, contributing to a significant carbon footprint. This has raised concerns among environmental advocates and prompted discussions about the sustainability of digital currencies.

As the demand for cryptocurrencies increases, so does the energy consumption associated with their mining and transaction processes. Critics argue that unless digital currencies find a more sustainable technological framework, they may exacerbate ongoing environmental challenges. This aspect can deter socially-conscious investors and users from engaging with certain digital currencies.

### Related Questions #### 1. How do digital currencies differ from traditional currencies?The distinction between digital currencies and traditional fiat currencies is pivotal to understanding their implications in finance. Traditional currencies, also known as fiat currencies, are government-issued and regulated, with a physical representation (like paper money or coins). In contrast, digital currencies exist only in electronic form and are typically not issued or regulated by any central authority.

While fiat currencies derive their value from government backing and economic stability, digital currencies often gain worth through market demand and supply dynamics. The blockchain technology behind many digital currencies offers transparency and security, unlike traditional banking systems, which can be convoluted and vulnerable to fraud.

Furthermore, the operation of digital currencies can be decentralized, while traditional currencies rely on centralized institutions. This decentralization presents unique challenges and opportunities for governance, economic freedom, and innovation. As the landscape of digital currencies evolves, understanding these contrasts will be crucial for users and policymakers.

#### 2. What are the security risks associated with digital currencies?While the underlying technology of digital currencies offers improved security measures, there are still several risks involved. The most notable risk arises from user behavior. Many digital currency wallets require users to manage their private keys securely. Losing access to these keys means losing access to funds permanently; there's no bank to reverse or recover transactions.

Moreover, digital currencies are often targeted by cybercriminals. Exchanges and wallets have previously been subject to hacks, leading to the loss of millions of dollars worth of currency. These incidents underscore the importance of adopting well-secured storage solutions, such as hardware wallets, and practicing cautious security habits.

Phishing attacks also pose significant risks, where malicious actors trick individuals into disclosing sensitive information. Thus, users must be informed and vigilant about recognizing potential threats and ensuring their digital asset management practices are secure and robust.

#### 3. How do digital currencies affect the global economy?The rise of digital currencies is beginning to shape the global economy in several ways. Firstly, they introduce competitive alternatives to traditional banking systems, potentially leading to increased efficiency in cross-border transactions. Lower fees and faster transaction times can benefit businesses engaging in international trade, broadening the scope for economic interaction.

Furthermore, as digital currency adoption increases, central banks are exploring the concept of Central Bank Digital Currencies (CBDCs). These state-backed digital currencies would harness the benefits of digital transactions while maintaining regulatory oversight. Implementing CBDCs could redefine how monetary policy is conducted and tighten government control over money supply and inflation rates.

Despite the potential benefits, there are also concerns about potential disruptions in the traditional banking sector. The widespread adoption of digital currencies could challenge established financial systems, raising questions about job displacement and economic stability. Navigating this transition will require careful policy consideration and regulatory frameworks to address the complex relationship between digital currencies and the global economy.

#### 4. What is the future of digital currencies in financial markets?The future of digital currencies in financial markets looks promising yet uncertain. As technology evolves, more sophisticated platforms and services will emerge, increasing accessibility and usability. Financial institutions are exploring ways to integrate cryptocurrencies into their offerings, recognizing the potential demand from younger generations in particular.

As institutional interest in digital assets grows, the infrastructure for trading and investing in digital currencies will become more robust, leading to greater mainstream adoption. This shift could result in increased stability in prices and make cryptocurrencies more appealing as a viable investment.

Regulatory clarity will play a crucial role in the future of digital currencies. Governments will need to find a balance between fostering innovation and maintaining necessary safeguards against fraud and illicit activities. The ongoing dialogue among regulators, financial institutions, and industry experts will be critical to shaping the landscape of digital currencies in financial markets.

### ConclusionIn summary, while digital currencies offer numerous advantages—such as financial inclusion, lower transaction costs, security, and decentralization—they also come with notable disadvantages, including volatility, regulatory uncertainty, and environmental concerns. The landscape of digital currencies is continuously evolving, and understanding these dynamics is vital for anyone considering participation in this innovative sector.

Despite the challenges, the potential for digital currencies to reshape the financial industry and enhance the global economy is significant. Ongoing education, adaptation, and regulation will be critical to realizing the full benefits while minimizing risks. As we navigate this brave new world, maintaining an informed perspective will empower users to make educated decisions about their involvement with digital currencies.

--- 希望以上内容帮助您更好地理解数字货币的优缺点!如有其他问题,请随时提出。